How many nonprofit organizations are out there?

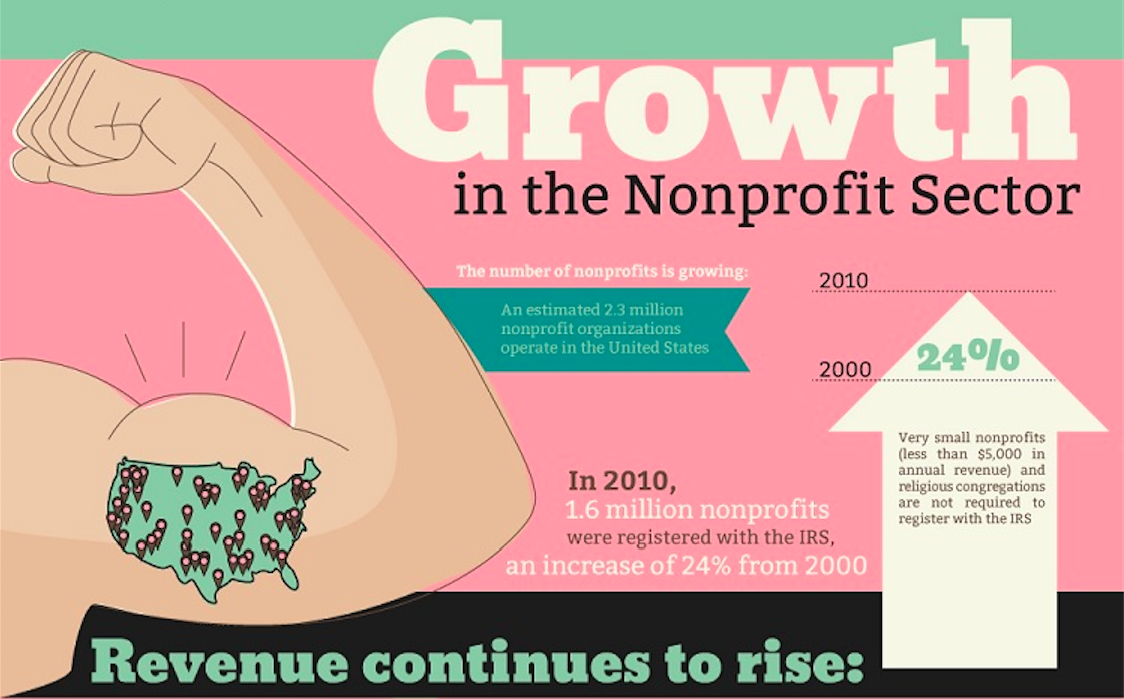

According to the The National Center for Charitable Statistics (NCCS) there are currently over 1.5 million nonprofit organizations in the United States. More than 188,000 organizations are tax-exempt and charity organizations registered in the State of California. It is difficult to quantify the number of nonprofits in the world as they diversify in the classification due to the financial, governance, and legal national specifications. Generally, we estimate there are about 10M nonprofits – social sector organizations in 196 countries. The largest number of registered nonprofit is in India (2M), followed by US (1.5M) and France (1.3M).

How do I form my own nonprofit organization?

The large number of registered non profits around the world demonstrates the significant impact of entrepreneurship and organizational activism in the social sector. It is also a personal expression of how people want to make a difference in the world and in our communities through innovative and new nonprofit organizations. The MNA program often receives requests for assistance in establishing new nonprofits and tax-exempt 501(c)3 organizations. To support these efforts and to promote sustainable and effective social sector organizations, we have created a list of resources to help you establish nonprofit and tax exempt organizations in the United States and the State of California.

Nonprofit Foundation Brainstorming

Begin the process by asking these important questions:

- What is the social benefit and charitable purpose of the organization?

- What kind of programming or core activities are you planning to do?

- Who are the intended beneficiaries?

- Are there existing nonprofits with a similar mission, and, if so, have you discussed your ideas with them?

- Can your mission be furthered more effectively and efficiently by partnering with an existing nonprofit?

- Can you attract sufficient resources to start and operate a new nonprofit?

- What is your revenue plan and business plan (including a three-year projected budget)?

- Are you familiar with the steps you need to take to start and run a nonprofit in compliance with the state laws and best practices?

- Have you considered alternatives to forming a new nonprofit, such as fiscal sponsorship and donor advised funds, or business-social enterprises?

- Will you need a an attorney and/or CFO to form the nonprofit and get it running? Read more here.

Establish a Nonprofit in 10 Steps

Step 1: PRELIMINARIES: Do we really need another organization? Preliminary market analysis and need assessment of other organizations and programs. Nonprofit, for-profit or hybrid? Check nonprofit organizations here.

Step 2: BASICS: What do you want to do? Determine the name, mission and anticipated programming and revenue sources of the organization. Check corporate name availability here.

Step 3: INCORPORATION: What state will you incorporate? Prepare the documents and forms necessary for the incorporation. Think about the entity type. Follow the application procedure of your state. Check California tips and resources here.

Step 4: BOARD: Who should be in your board? People should be invited to serve based on their qualifications and contributions in treasure, time or talent. Generally, boards have a minimum of a president (chair), a treasurer and a secretary. Hold your first board meeting appropriately (RONR) and document it with minutes. Check IRS exceptions here.

Step 5: BYLAWS: What are the essential documents of the organizations? A corporation’s bylaws includes the fundamental provisions related to the management of the activities and affairs of the corporation. Bylaws should also provide guidance to the board and reassurance of sound governance. You should also prepare other important documents such as the corporation’s policies and conflict of interest (COIs). The bylaws need to be approved by the board. Check the essential text of bylaws here.

Step 6: EIN: How do you obtain an employer identification number? An officer or authorized third party designee (e.g. attorney) may apply to obtain an EIN number for the organization. Check this to apply for an EIN online.

Step 7: REGISTER: What other registrations are required? In California an annual registration is required for nonprofit public benefit corporations to be filed within 30 days after receipt of assets (Form CT-1). It is also required to file a Statement of Information with the State Department (Form SI-100). Check here for the online forms.

Step 8: TAX-EXEMPTION: How do I obtain a tax-exemption status? Completing the Form 1023 application for exempt status under Internal Revenue Code (IRC) Section 501(c)(3) is a challenging process. Once you complete the federal tax exemption (IRS application) you will need to apply for state exemption (California Franchise Tax Board (FTB) and receive an affirmation of exemption letter from the FTB. Check here the IRS tools and instructions.

Step 9: FINANCIALS: Does the nonprofit need a bank account? Open a bank account and establish check signing procedures. To maintain tax-exempt status and establish a good governance practice in your organization is important to establish a prudent system of checks and balances when dealing with the finances of an organization. Check here for best practices and financial tools.

Step 10: COMMUNICATION: How do I make a good web presence? A professional website and active social media presence are a must for a serious nonprofit organization. There are a number of free web management tools such as WordPress.com that can be helpful with templates. Integrated contacts, fundraising and analytics are also becoming essential practices for successful, sustainable and effective nonprofits. Check for integrated solutions here.

Beyond these steps: There are other important elements that will be necessary to make your nonprofit effective with its mission. Please look at the additional competencies and resources in various areas of nonprofit management and leadership listed on the INNOVATION page and emphasized in MNA curricula.

Resources & Learn more

Click on the Logos of the Foundation Center and CalNonprofit for more information and resources:

the information is very interesting, Thanks You

grosir kaos polos