Earlier this year, I wrote about the student at Duke University who reported she was paying for college by acting in pornographic movies. Her story received a lot of publicity, including much that decried the need for this woman to resort to a career in pornography to pay her tuition bills. As I asked at the time,

A telling story of the state of college affordability in the nation? Not at all. It is simply the story of the choices made by one young woman, and we should not attach any importance to what she has done.

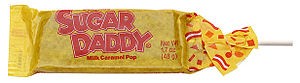

This school year, a similar story is making the rounds, most prominently in an article in The Atlantic last fall, “How Sugar Daddies Are Financing College Education.” According to the story, a website called SeekingArrangement.com reports it has over 2 million women members (“Sugar Babies”) who join the site “where beautiful, successful people fuel mutually beneficial relationships” in order to meet “Sugar Daddies.” This might sound like any other dating website, albeit one for people who have a self-inflated image of themselves. But The Atlantic article alleges that this site differs from others in that the women there are looking to get paid for their relationship with the men on the site, or to put it more directly, they are offering escort or prostitution services. A follow-up article in The Atlantic this month highlights colleges and universities across the country that have a proportionally large number of women registered on the site. Other media have covered the phenomenon of sugar babies and sugar daddies as well.

Continue reading “Candy, escort services, and college financing”

This week’s New York Times contained a piece by economics columnist Eduardo Porter titled “

This week’s New York Times contained a piece by economics columnist Eduardo Porter titled “

I’ve

I’ve  More recently, Yahoo published a

More recently, Yahoo published a