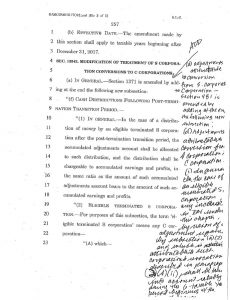

The competing House and Senate tax reform bills are large, complex, and often difficult to understand. The Senate bill, for example, is a 479-page document that was passed early in the morning last Saturday and that included last-minute, hand-written passages as shown to the right.  There are numerous parts of each bill that have a large impact on colleges and universities in the country, as well as their students. One estimate calculated after the House bill was passed is that if enacted into law, it would cost students and their families $71 billion over the next ten years. Now that both chambers have passed bills, a conference committee will try to hash out the differences and agree on one bill to be passed by both the House and Senate and sent on to President Trump to be signed into law. Continue reading “Tax reform that harms graduate students and university employees”

There are numerous parts of each bill that have a large impact on colleges and universities in the country, as well as their students. One estimate calculated after the House bill was passed is that if enacted into law, it would cost students and their families $71 billion over the next ten years. Now that both chambers have passed bills, a conference committee will try to hash out the differences and agree on one bill to be passed by both the House and Senate and sent on to President Trump to be signed into law. Continue reading “Tax reform that harms graduate students and university employees”