Student loans continue to be a popular topic in the media, with most of the stories (at least upon a quick glance) focusing on how terrible the growing volume of student loans is. A Google news search on one day for the phrase “student loan debt” turned up the following headlines among the top results:

- Student debt threatens the safety net for elderly Americans

- Student loan and mortgage loan debt: A public health crisis

- Student loan debt and the homeownership dream

- Student loan debt is weighing college graduates down

- Student debt hurts more than your wallet

As I have pointed out in other posts here and here, many of these stories highlight individuals who borrowed a large sum of money to pay for college, people who are often presented as a typical borrower. But the reality is very different from the rhetoric.

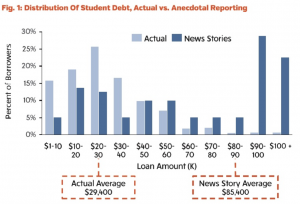

Hamilton Place Strategies, a consulting firm in Washington, D.C., conducted a study in which it “examined close to 100 articles over a three month period which had stories of students and families burdened by student debt.” Data from the U.S. Department of Education’s National Postsecondary Student Aid Study (NPSAS), which surveyed a nationally representative group of over 100,000 undergraduates in the 2011-12 school year, show that the average senior that year had accumulated student loan debt of $29,400 by the end of her senior year. In the stories reviewed in the Hamilton Place Strategies study, the student loan debt of the individuals profiled averaged $85,400, or almost three times as high as the real figure. As the study pointed out, “If this reporting were a random sample of students for stories about debt, there is a 0.000007 percent chance reporters would get these results.” The figure above compares the distribution of actual loan debt in the NPSAS survey with what is shown in the news stories.

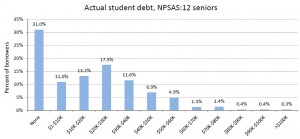

And the $29,400 figure actually overstates the actual borrowing, because it is the mean amount borrowed for students who took out any loans during their college careers (the median amount borrowed for those who did borrow was $26,500). In addition, 30 percent of the seniors did not take out any loans at all. So including the students who did not borrow, the actual distribution looks like this (I calculated these figures using the Department of Education’s PowerStats tool):

:

As the Hamilton Place Strategies study points out, focusing on students who are well out in the tail of the distribution may make for good copy, but it presents readers with a very misleading portrait of what is happening with student loan debt today.

As I pointed out in two columns I wrote recently for the Washington Post’s Answer Sheet blog (which you can read here and here), there are a lot of concerns regarding student loan debt. But highlighting students who are far from typical does not help move the dialogue forward in a constructive fashion.